Bookkeeping

The Beginner’s Guide to Bookkeeping

Content

More specifically, it ensures all your income and expenses are recorded and organized correctly, such as dates and business categories. Accounting is a high-level process that uses financial data compiled by a bookkeeper or business owner to produce financial models. Maintaining a general ledger is one of the main components of bookkeeping. The general ledger is a basic document where a bookkeeper records the amounts from sale and expense receipts.

Little Chats with some Mansfield business women, Jeanette C … – Richland Source

Little Chats with some Mansfield business women, Jeanette C ….

Posted: Tue, 07 Mar 2023 16:15:00 GMT [source]

For smaller errors, such as transcription errors, they may make corrections themselves. In case of major discrepancies, they typically notify senior staff, including accountants and auditors. In addition, they may handle payroll, make purchases, prepare invoices, and keep track of overdue accounts. The information on this site cannot be relied on as accurate and up to date.

Regulations for a Bookkeeping Business

In most cases, employers want to accounting and bookkeeping for small business someone with a bachelor’s degree, and a master’s degree may help boost your earnings. She holds a Bachelor of Science in Finance degree from Bridgewater State University and helps develop content strategies for financial brands. Flatworld Solutions offers a gamut of services for small, medium & large organizations.

- It’s a process that tells the financial story of your business, including if your business is profitable or if you’re suffering a loss.

- An accounting professional will help you create a plan; ultimately saving you time and money in the future and reduce your workload.

- Doing so can free up your time to focus on other aspects of running your business.

- Note that each professional designation may set its own educational and professional experience requirements.

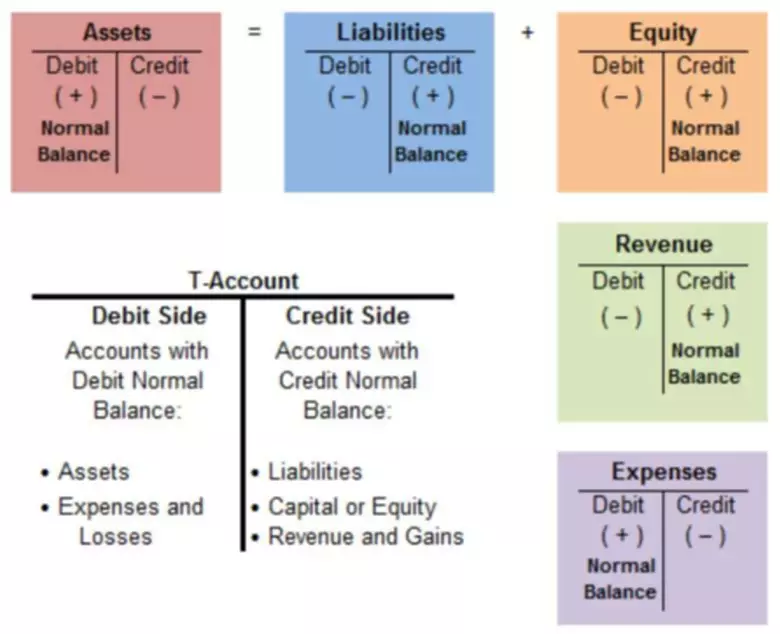

Effective bookkeeping requires an understanding of the firm’s basic accounts. These accounts and their sub-accounts make up the company’s chart of accounts. Assets, liabilities, and equity make up the accounts that compose the company’s balance sheet. If your company is larger and more complex, you need to set up a double-entry bookkeeping system. At least one debit is made to one account, and at least one credit is made to another account. As the business grows, you might have to enlarge your bookkeeping and accounting team to help you with cashflow for more than just the tax season.

The Distinctions between Accounting and Bookkeeping

Learn which technical skills employers are looking for, how to improve yours, and how to list them on your resume. Greg DePersio has 13+ years of professional experience in sales and SEO and 3+ years as a freelance writer and editor. In just 5 minutes, we’ll get to know you and the kind of help you’re looking for. The percent change of employment for each occupation from 2021 to 2031. Work experience that is commonly considered necessary by employers, or is a commonly accepted substitute for more formal types of training or education.

The link below go to OEWS data maps for employment and wages by state and area. Employers generally prefer to hire candidates who have a high school diploma and have completed college courses in related subjects, such as accounting. Learn the basics of bookkeeping and understand accounting by taking our free courses… The work of bookkeeping professionals is vital because it can affect so many different aspects of the business.

Take the confusion out of bookkeeping

Simply put, bookkeeping is more transactional and administrative, concerned with recording financial transactions. Accounting is more subjective, giving you insights into your business’s financial health based on bookkeeping information. Check out our reviews of the best accounting software for small businesses so you can create invoices, record payments, collect receivables and run reports that help you manage your financial health. The NACPB offers credentials to bookkeepers who pass tests for small business accounting, small business financial management, bookkeeping and payroll. It also offers a payroll certification, which requires additional education. Staying on top of your finances is a key part of being a successful small business owner.

- Here’s what you need to know about these two roles to determine which one your business needs.

- The accounting clerks will be supervised by one or more accountants.

- However, significant differences exist, like work conducted in each career and needed to be successful.

- Other smaller firms may require reports only at the end of the year in preparation for doing taxes.